Convertible Notes and the Maturity Date Dilemma: A Case Study from Delaware

When investors use convertible notes to invest in early-stage startups, they aren’t looking for interest payments. The goal is equity. They expect the startup to raise a priced round, at which point the notes will convert at a discount.

And what if that never happens?

That’s where the maturity date comes into play. If the company hasn’t raised a qualified financing round (or another triggering transaction) by that point, the noteholders don’t just sit indefinitely waiting for conversion. Usually, one of three things happens:

The notes convert into common stock at a predetermined price.

The company repays the notes, plus interest.

The maturity date gets extended by agreement.

But it must be spelled out in the convertible note.

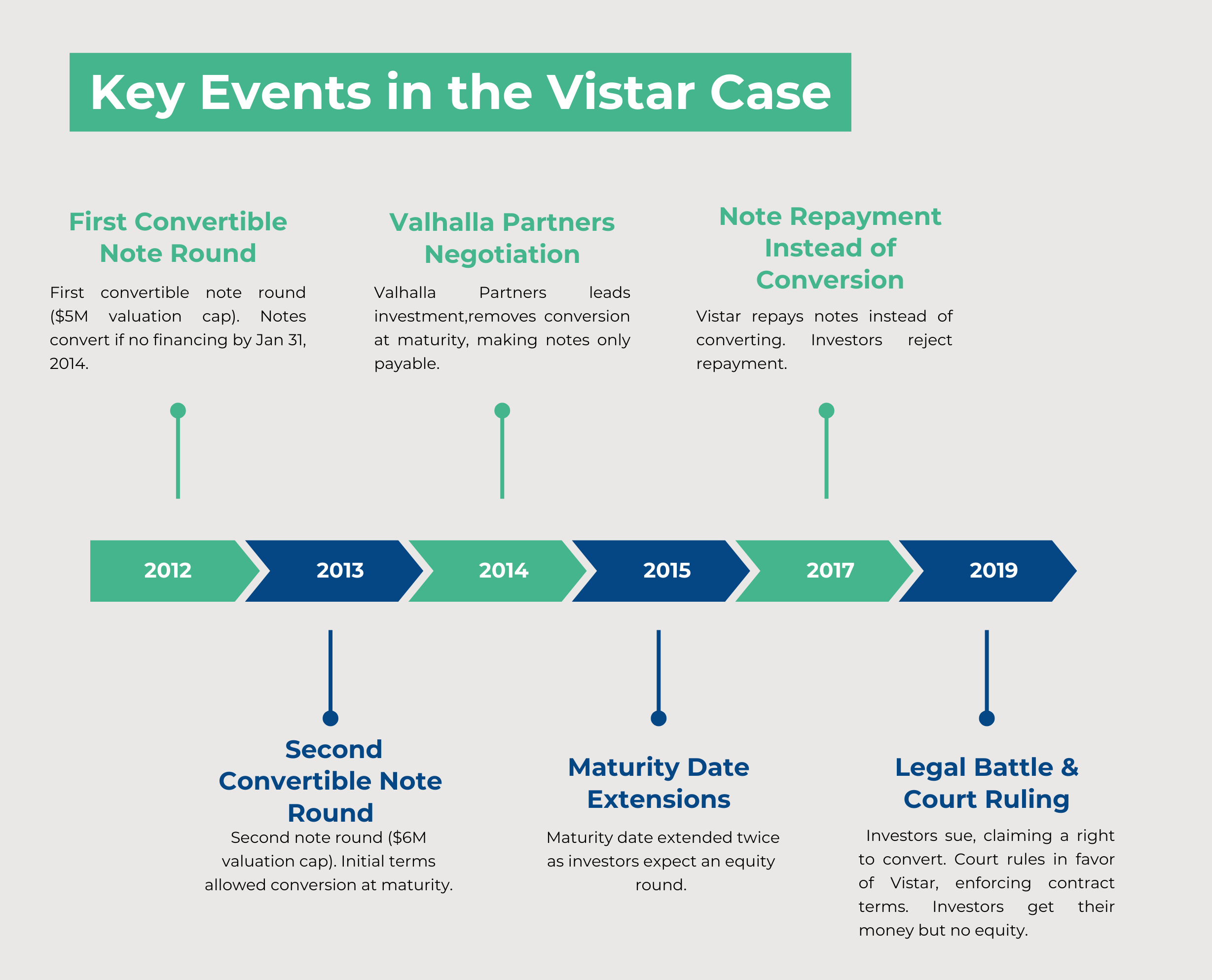

A recent Delaware case involving Vistar Media, Inc. highlights why maturity terms deserve just as much attention as the discount and valuation cap. The investors assumed their notes would convert, but the contract didn’t give them that right.

The investors sued and lost.

The Vistar Case: How Investors Lost Their Right to Convert

Round One: Friends & Family Notes

Vistar Media, an advertising technology company, raised its first round of convertible notes in 2012, mostly from friends and family. These notes had a clear provision: if the company didn’t raise a qualifying financing before January 31, 2014, they would convert into common stock at a valuation of $5 million, which is what happened. No dispute yet.

Round Two: A Change in Terms

By late 2013, Vistar needed more funding. The company tried to raise an equity round but couldn’t agree with VCs on valuation and dilution. Instead, it turned to another round of convertible notes, this time targeting angels, venture firms, and strategic ad-tech investors.

The new notes were initially structured like the first round, with a conversion feature at maturity. The only change was an increased valuation cap of $6 million.

Then came the negotiations with Valhalla Partners II, L.P., which led the round. Valhalla rejected the idea that the notes would automatically convert at maturity, arguing that wasn’t standard market practice. Instead, it proposed that noteholders should have a choice: either get repaid or extend the maturity date.

Vistar countered with a revised draft that appeared to reflect Valhalla’s request. But there was a key difference: investors could choose to be repaid or convert into common stock at the $6 million valuation cap. The right to extend was missing.

Valhalla responded with a “cleaned up” version of the note, which removed the option to convert altogether. The final draft, which Vistar and the other investors accepted, stated that if no equity financing occurred, the notes were simply “payable” at maturity.

This language would later become the heart of the legal dispute.

Fast-Forward to 2017: Investors Expect Equity, Vistar Sends a Check

The original maturity date of the Second Round Notes was September 30, 2014. Vistar asked investors to approve an extension, citing strong revenue growth that reduced the need for outside funding. Investors agreed. In 2015, Vistar requested another extension, and again, investors agreed.

By early 2017, Vistar’s board approved repayment of the notes, along with a $20 million debt financing and a stock repurchase plan. On March 16, 2017, the company notified noteholders that it was repaying them in full.

The investors rejected the checks, arguing that the notes should convert to equity. They claimed they had expected their capital to remain in the company until a priced round occurred. Instead, they were being treated like lenders rather than venture investors.

The Lawsuit: Did the Investors Have a Right to Convert?

In 2019, the noteholders sued Vistar in Delaware’s Court of Chancery. They claimed:

They had the right to convert at maturity, despite the contract language.

Vistar had misled them into thinking an equity round was imminent.

The company should be prevented from forcing repayment under principles of equity.

Vistar countered with a breach of contract claim, arguing that investors had no right to reject repayment.

The Court’s Rulings: A Win for Vistar

The court issued two rulings, both in favor of Vistar.

First, the court adopted Vistar’s contractual interpretation. The notes stated that if no qualifying financing occurred, they were “payable” at maturity. There was no mention of a right to convert or extend.

Second, the court rejected the investors’ claims for equitable relief. The investors pointed to Vistar’s financial statements, which described the notes as a “purchase of stock,” and to statements the company had made to third parties calling the notes “basically an equity instrument.” They argued these statements created a reasonable expectation that the notes would convert. The court disagreed, ruling that investors could not rely on third-party statements or accounting classifications to override the plain terms of the contract.

The investors walked away with their money but no equity.

Key Events in the Vistar Case

Key Takeaways for Founders and Investors

For Investors:

Never assume that conversion is automatic at maturity. If conversion rights are important, they need to be explicitly written into the contract.

If you want the ability to extend the maturity date instead of being repaid, make sure it’s included in the terms.

Pay close attention to last-minute changes in deal documents. In this case, the option to convert at maturity disappeared in the final draft.

For Founders:

Be careful not to make implicit promises about future equity rounds. Statements suggesting that an equity financing is imminent could create legal risks.

If you want control over what happens at maturity, structure the note accordingly. The “payable at maturity” language in this case allowed Vistar to avoid unwanted dilution.

Standardization in convertible note terms is still lacking. Unlike SAFEs or NVCA venture financing documents, convertible notes vary widely in their provisions, which makes it essential to negotiate clear terms.

Convertible Note Checklist for Investors & Founders

Final Thoughts

Convertible notes are designed to convert, not to be repaid. But what happens at maturity is just as important as what happens at conversion. Investors should demand clarity, and founders should avoid ambiguity. Otherwise, they might find themselves in court fighting over whether a note is truly an equity instrument or just a loan.