The ACA Convertible Note: A Step Toward Standardization in Early-Stage Investing

Early-stage startup investing spans a range of deal structures, balancing simplicity, control, and risk. On the founder-friendly end, the SAFE (Simple Agreement for Future Equity) offers a straightforward approach: investors provide capital upfront but receive only limited rights, with valuation deferred until a later funding round. At the other end, a priced round involves direct equity ownership, typically in the form of preferred stock and often grants investors additional economic and management rights, documented in formal governance agreements.

The convertible note sits between these two extremes. It provides investors with some protections, such as interest, maturity dates, and sometimes collateral, while delaying a full valuation decision.

Founders and investors alike have benefitted from popular, standardized legal documents, that facilitate productive negotiation and reduce legal fees. The SAFE is an open-source template promoted by Y Combinator; venture capital-lead seed and A-series rounds, although more heavily negotiated and customized to the particular founder-investor relationship, often use popular document templates as the starting point in negotiations.

But, until recently, no similar standardized documents existed for convertible notes in the early-stage startup community.

The ACA Convertible Note: A New Industry Benchmark?

The Angel Capital Association (ACA) recently introduced the ACA Note, a model convertible note that aims to bring structure and predictability to these agreements. Its stated goal is to balance the rights of founders and investors by incorporating common convertible note provisions alongside best practices often found in side letters.

The ACA Note introduces several features not typically included in early-stage convertible notes but frequently requested by experienced investors. Some of the most significant are:

Expanded representations and warranties: Designed to provide investors with useful company disclosures while avoiding the complexity of later-stage deals.

Participation rights in future financings: Allows investors to maintain their ownership percentage by participating in subsequent funding rounds.

Information rights: Requires the company to provide annual and quarterly financials, cap tables (upon request), and updates necessary for compliance with securities regulations. Investors may also negotiate for a management rights letter to ensure continued access to company information after the note converts.

Most favored nation (MFN) provisions: Protects investors by ensuring that if a company issues a more favorable convertible note to a later investor, earlier noteholders automatically receive those same terms.

Board observer rights: Gives investors the ability to attend board meetings or, in some cases, appoint a board member. This provision is more common in larger note rounds and is often paired with director indemnification and D&O insurance requirements.

Protective provisions: Requires majority noteholder approval for certain corporate actions while the notes are outstanding. While priced rounds often give preferred stockholders veto power, convertible noteholders typically do not have this level of control.

IP agreements: Ensures all employees and contractors sign confidentiality and proprietary rights agreements, a crucial but sometimes overlooked aspect of due diligence in early-stage investing.

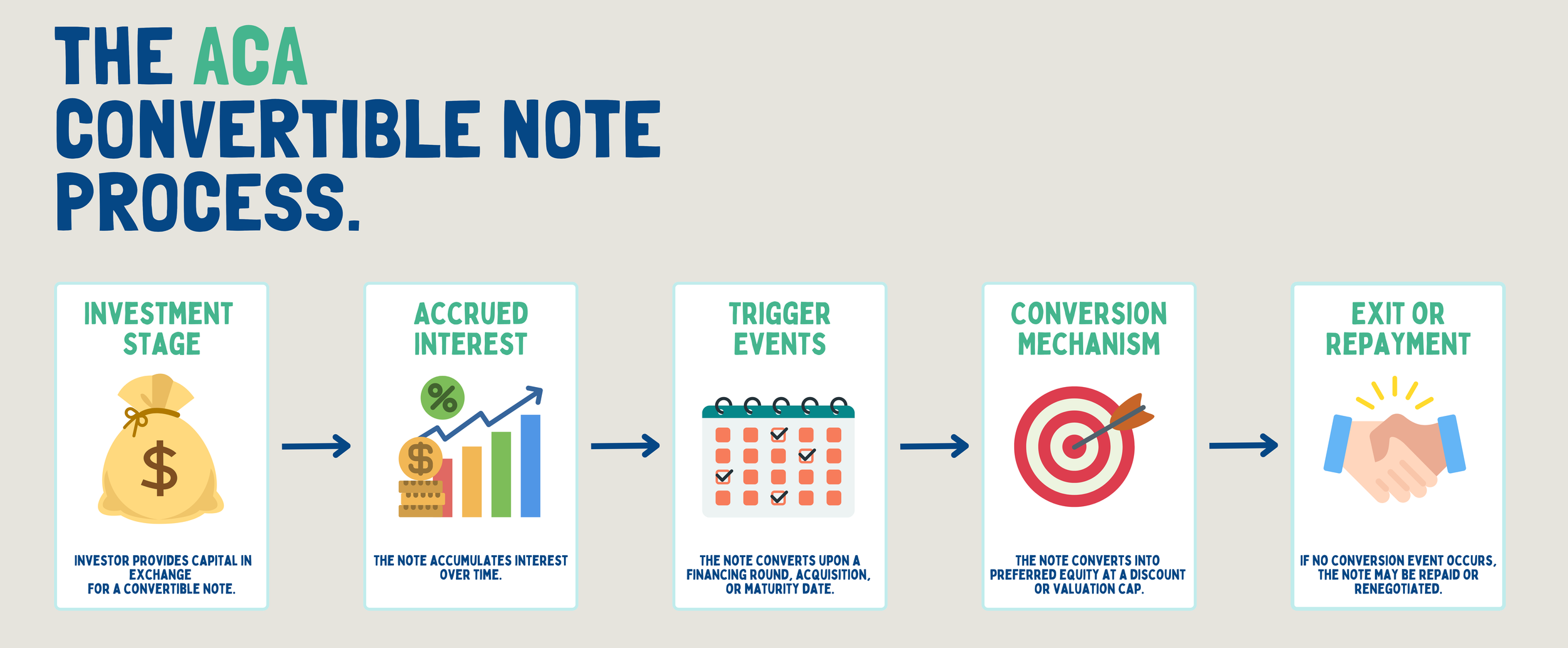

The ACA Convertible Note Process

What Founders and Investors Should Consider

While the ACA Note aims to balance the interests of founders and investors, its terms lean more investor-friendly than many traditional convertible notes. This means both sides need to pay close attention to key provisions that could impact their rights and flexibility down the line.

For startup founders, a critical consideration is the financial and reporting obligations baked into the ACA Note. Unlike simpler instruments like SAFEs, these notes require companies to provide financial statements (often GAAP-compliant) and other business updates. But early-stage startups often lack the resources for formal financial reporting. Founders should consider whether they have the operational capacity to comply with these requirements or negotiate more lenient reporting obligations.

The investor approval rights included in the ACA Note also warrant close scrutiny. Some convertible notes allow founders to operate with minimal investor interference before a priced round, but the ACA Note introduces protective provisions that could give noteholders a say in key business decisions. This could limit flexibility in areas such as taking on new debt, issuing additional convertible notes, or making strategic business pivots. Founders should be mindful of how much control they’re ceding and whether they can build consensus among investors when critical decisions arise.

Another notable difference between the ACA Note and the SAFE is the ability to modify terms. The SAFE, as published by Y Combinator, explicitly prohibits modifications outside of filling in blanks and bracketed terms, ensuring consistency and preventing excessive negotiation. The ACA Note, however, leaves room for adjustments, which means founders and investors can tailor terms to their specific needs. While this flexibility can be beneficial, it also means negotiations could become more complex, potentially increasing legal costs and delaying funding. Startups should be strategic in deciding which terms are worth negotiating and which are best left as standard.

For investors, the ACA Note offers stronger protections compared to traditional convertible notes, making it an attractive option. The inclusion of most favored nation (MFN) provisions ensures that early investors won’t be left with weaker terms if the company later issues more favorable convertible notes. This can help mitigate the risk of dilution or unfavorable deal structures in future funding rounds.

The Negotiation Process for a Convertible Note

The note’s board observer rights and protective provisions also provide investors with greater visibility and influence over company decisions. This is particularly valuable in larger convertible note rounds, where investors may want oversight before committing to a later equity investment. However, investors should consider whether they want to actively monitor company performance or if they prefer a more passive investment approach. Increased oversight responsibilities could require additional time and engagement.

If widely adopted, the ACA Note could help streamline convertible note financing in the same way NVCA documents standardized venture rounds and SAFEs simplified early-stage investing. Standardized documents reduce legal costs, set clear expectations, and improve transparency in negotiations. However, adoption will depend on how both founders and investors perceive the balance of rights and whether the market sees the ACA Note as a fair middle ground.

Ultimately, the ACA Note represents a step toward greater structure and predictability in convertible note financing. But as with any investment instrument, the details matter. Both startups and investors should approach these notes with a clear understanding of the legal and business implications to ensure they align with their long-term goals.